Astraea Wealth

- Who is Astraea?

- Nuggets of Knowledge

- …

- Who is Astraea?

- Nuggets of Knowledge

Astraea Wealth

- Who is Astraea?

- Nuggets of Knowledge

- …

- Who is Astraea?

- Nuggets of Knowledge

Service options

Astraea Wealth Management is a fee-only advisor. That means, you will never be charged a commission or recommended anything that is not in your best interest. Learn more about what "fee-only" means, and why it's the best, here.

ongoing, comprehensive financial planning & investment management

The best financial & life planning happens in a committed, ongoing relationship. This holistic approach helps you with all things financial in your life- ranging from feedback on your open enrollment benefits options each year to complicated investment and life questions. For these clients, Astraea has an Assets Under Management ("AUM") model which covers all financial planning and investment manangement. What this covers is best explained in the "Problems we help solve" section.

The typical asset range of clients that partner with Astraea for annual ongoing compressive planning is between $1 million -$10 million, or if assets are below that, household annual income averaging >$100,000/person.

one time plan

Not ready to commit to an ongoing relationship, or prefer to manage your investments yourself? No problem, flat fee options are available.

This is typically a 4 step process:

1) Meet to understand your concerns and desires. You send relevant financial information to Astraea

2) Meet to review your initial financial plan, as well as scenarios/tradeoffs for different options in your plan

3) Meet to discuss Astraea's recommendations for your situation based on information gathered steps 1 & 2

4) Implementation is completed by client

Once we understand your specific situation and planning requirements, we will be able to provide you with a fee that matches your situation.

And guess what? If you like how we operate, we can convert this into an ongoing annual financial planning relationship!

For questions on investments and other related items, click here.

How much value does an advisor really add?

Vanguard estimates ~3% annualized*.

As a former scientific reasearcher, I look to data to support claims. Therefore, when Vanguard conducted a study and published a whitepaper on the value of an advisor following their framework, I was compelled to share it. They started this study in 2001, and continue to revisit and update it. The data below are from the 2022 paper.

The primary focus of Vanguard's study was to highlight why advisors add value and those reasons include:

- Providing suitable investment recommendations;

- Regular rebalancing of portfolios;

- Developing spending strategies for retirement income; and

- Guidance to help adhere to a financial plan.

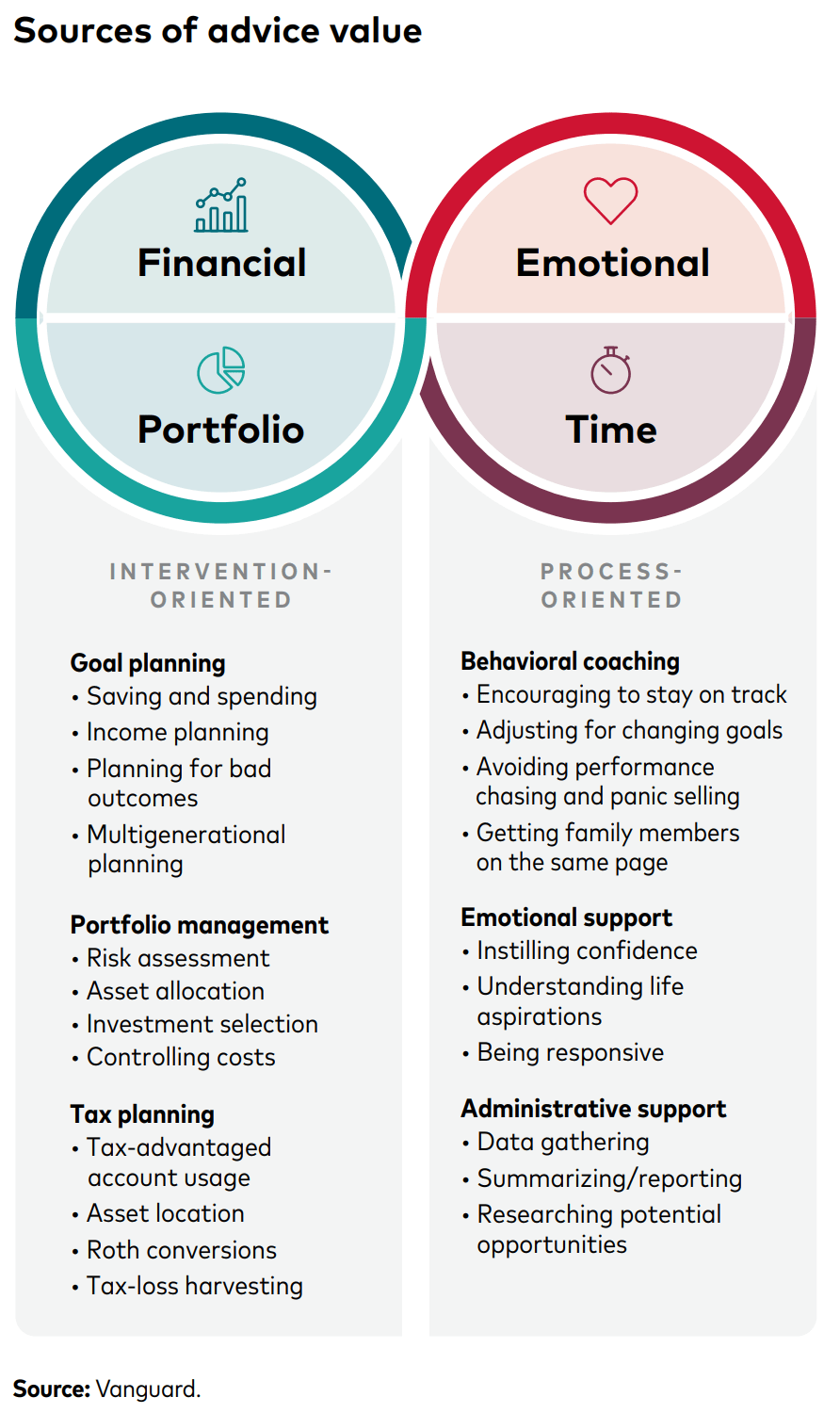

Vanguard expands its traditional rubric for examining the value of advice (financial, portfolio, and emotional) to include time value because human advisors and digital advice platforms can perform tasks that individual investors might not have the time, willingness, or ability to perform on their own. The figure to the left shows how specific types of advice interventions and activities map to this value framework.

*"Based on [Vanguard's] analysis, advisors can potentially add up to, or even exceed, 3% in net returns by using the Vanguard Advisor's Alpha framework.

Because clients only get to keep, spend, or bequest net returns, the focus of wealth management should always be on maximizing net returns. We do not believe this potential 3% improvement can be expected annually; rather, it is likely to be very irregular. Further, the extent of the value will vary based on each client's unique circumstances and the way the assets are managed" (pg 4, Quantifying Advisor Alpha - this paper )

If you seek out a financial advisor who is both a fiduciary, meaning that they act in your interest, and a financial planner, you may very well increase your growth opportunities over investing solely on your own.

The full copy of this report can be found here.

*IMPORTANT: The projections and other information generated by the Vanguard Capital Markets Model regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. VCMM results will vary with each use and over time.

Note: "basis points" means .01%, so 100 basis points = 1.00%

Subscribe to our newsletter.

Sign up with your email address to receive news and updates.

Investment advisory services offered through Equita Financial Network, Inc. an Investment Adviser with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. Equita Financial Network also markets investment advisory services under the name, Astraea Wealth Management LLC. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption.

All written content on this site is for information purposes only. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation. Securities investing involves risks, including the potential for loss of principal. There is no guarantee that any investment plan or strategy will be successful.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization’s initial and ongoing certification requirements to use the certification marks.